Notice of delinquent taxes

STATE OF MINNESOTA IN DISTRICT COURT

COUNTY OF ROCK FIFTH JUDICIAL DISTRICT

Court File No. 67-CV-AD-24-2

NOTICE OF DELINQUENT REAL ESTATE TAXES PAYABLE 2023

THE STATE OF MINNESOTA, TO ALL PERSONS, COMPANIES, OR CORPORATIONS WHO HAVE OR CLAIM ANY ESTATE, RIGHT, TITLE, OR INTEREST IN, CLAIM TO, OR LIEN UPON, ANY OF THE SEVERAL PARCELS OF LAND DESCRIBED IN THE LIST HERETO ATTACHED:

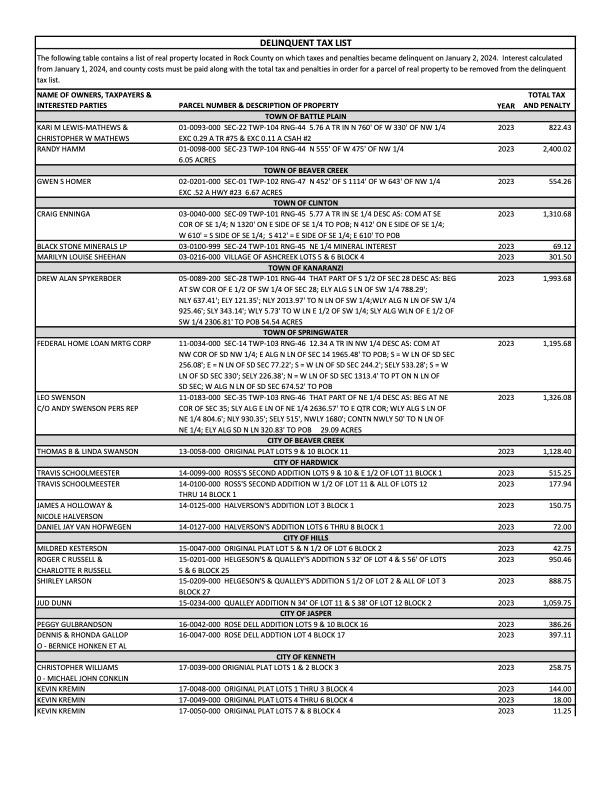

A list of real property in Rock County on which delinquent property taxes and penalties are due has been filed with the District Court Administrator of Rock County.

This list is published to inform all persons that the listed property is subject to forfeiture because of delinquent taxes.

The property owner, taxpayer, or other interested person must either pay the tax and penalty, plus interest and costs or file a written objection with the District Court Administrator. The objection must be filed by 4/17/2024, stating the reason(s) why the tax or penalty is not due on the property. If no objection is filed, a court judgment will be entered against the property for the unpaid tax, penalty, interest and costs.

For property under court judgment, the period of redemption begins on 5/13/2024. The period of redemption means the time within which taxes must be paid to avoid losing the property through forfeiture. The period of redemption is three years, with a handful of exceptions. The redemption period is one year for most properties located in a targeted neighborhood, as defined by Minnesota laws, and for the municipal solid waste disposal facilities. The redemption period is five weeks for certain abandoned or vacant properties.

You may also enter into a confession of judgment as an alternative method to paying off the delinquent tax amount and avoiding forfeiture. This allows you to pay the delinquent balance in equal annual installments, with a down payment due at the time you enter into the confession. The length of the installment plan varies: five years for commercial/

industrial/public utility property; 10 years for all other properties.

If you have homesteaded property, you may be eligible for a Senior Citizen’s Property Tax Deferral, which enables seniors to pay just three percent of their total household income and allow remaining amounts to become a lien on the property that may be deferred for later payment (perhaps upon eventual sale of the property). It should also be noted by property homesteaders that you are ineligible to receive the property tax refund while you owe delinquent property tax.

To determine how much interest and costs must be added to pay the tax in full, contact the Rock County Auditor/Treasurer’s Office, Rock County Courthouse, 204 East Brown St, PO Box 509, Luverne, Minnesota 56156-0509. You may also contact the Auditor-Treasurer at (507) 283-5060 or ashley.kurtz@co.rock.mn.us.

/s/ Natalie Reisch

Rock County Court Administrator

5th Judicial District (Court Seal)

Date: February 14, 2024

/s/ Kendra L. Dobie

TATE OF MINNESOTA

COUNTY OF ROCK

Ashley Kurtz, being duly sworn, deposes, and says that she is the Auditor-Treasurer of the county of Rock; that she has examined the foregoing list, and knows the contents thereof; and that the same is true and correct.

(Official Seal)

/s/ Ashley Kurtz, Auditor-Treasurer

Subscribed and sworn to before me this 14th day of February, 2024.

(Notary Seal)

/s/ Vanessa J. Luettel

Notary Public, Nobles County, Minnesota

(03-28)