Property owners will soon receive valuation notices showing what the Rock County Land Records Office has determined their property’s estimated market value to be as of Jan. 2, 2023.

That figure will be used to calculate the 2024 taxes for the property.

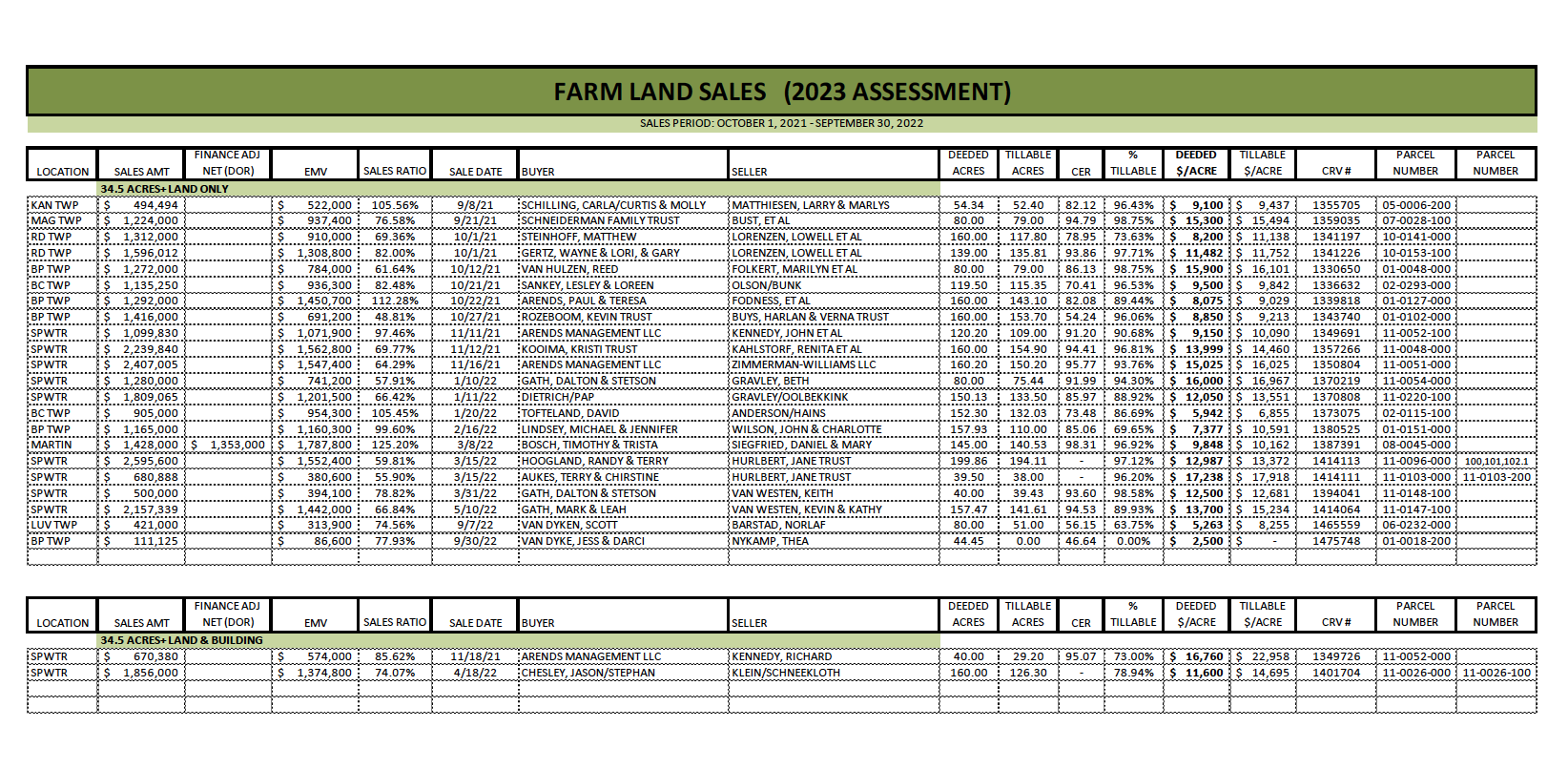

According to Rock County Assessor Rachel Jacobs, most farmland in Rock County has increased in value, because land sale amounts have increased.

Rock County’s land values are increasing on average 25 percent.

But in Springwater Township, she said she’s alerting local officials that property values are set to increase by as much as 65 percent, and she’s attempting to explain why.

Typically, she said local townships have only a few land sales in a year, but Springwater Township had 11 land sales in her assessment period of October of 2021 through September of 2022.

Of those 11 sales, six went for $13,000 per acre or more, and four went for over $15,000 per acre. One 40-acre parcel sold for over $17,000 per acre.

“That’s high,” Jacobs said. “These are some of the highest sales I’ve seen since working in this office.”

She said in a typical year, there might be three land sales in a township over $10,000 per acre.

“In Springwater I have only one that’s below $10,000 per acre,” she said.

“It puts into pretty good perspective what people have been willing to pay for land in Springwater Township.”

She said the 11 sales were mostly auction sales between local sellers and buyers, not foreign investors.

By statute, estimated market value must be between 90 percent and 105 percent of the actual market value for like properties, so an ag land sale affects neighboring properties’ valuations.

To bring Springwater Township’s tillable land values in line with statute, the new valuations will need to increase 65 percent, based on the 11 recent sales.

Jacobs said if it’s only one or two sales, the averages aren’t as affected.

But in Springwater Township, where 11 sales were all comparatively high, nearly all of Springwater Township’s land values will increase.

“I have to use those 11 sales to determine estimated market values,” she said.

Further, Jacobs said Springwater’s per-acre land values have historically been lower than most others in Rock County with similar soil types, so the recent land sales will have an even steeper impact on neighboring land values.

Valuation increases

don’t directly correlate with tax increases

She points out, however, that increased valuations don’t necessarily mean taxes will go up.

It’s true that increases in valuation relative to other properties can affect taxes, but many other factors also affect taxes.

They include changes in a levy, economic development, shifts in classification and operating levies (by school districts, for example).

Sometimes local governments can increase their levies, but with other economic growth, property taxes do not rise.

Jacobs said she expects property owners will have questions after they receive their valuations, and she encourages people to contact her at 507-283-5022 or rachel.jacobs@co.rock.mn.us.

There are meetings where residents can challenge their assessments. The local Board of Appeals and Equalization meetings will be during the second week in April.

If property owners call ahead of those meetings, assessors can research and review the specific parcel(s) to thoroughly answer property owners’ questions.

Property owners should have their parcel’s address and ID ready to save time. There is a limited amount of time in which to challenge a property’s valuation.

The valuation notices that go out in the next two weeks will affect taxes payable in 2024.

Residents will also soon receive their 2023 tax statements, which show the 2022 assessed value of the property and total taxes owed this year.