Despite high consumer demand for meat in the coronavirus economy, livestock farmers are receiving lower prices for their products than before the pandemic.

Meanwhile, four companies — Tyson, JBS, Cargill and National Beef — control 85 percent of U.S. beef processing and are achieving sizeable profits.

That’s why Minnesota Attorney General Keith Ellison joined attorneys general in 10 other states to request a U.S. Department of Justice investigation into price fixing by multinational meat companies.

“… live cattle futures recently hit 18-year lows, while the price of boxed beef and consumer demand remain healthy, especially as consumers navigate these unprecedented times," the attorneys wrote in a letter to U.S. Attorney General William Barr.

"In this highly concentrated industry, meat packers have achieved sizeable profit margins. Cattle ranchers, however, who for generations have supplied our nation's beef, are squeezed and often struggle to survive."

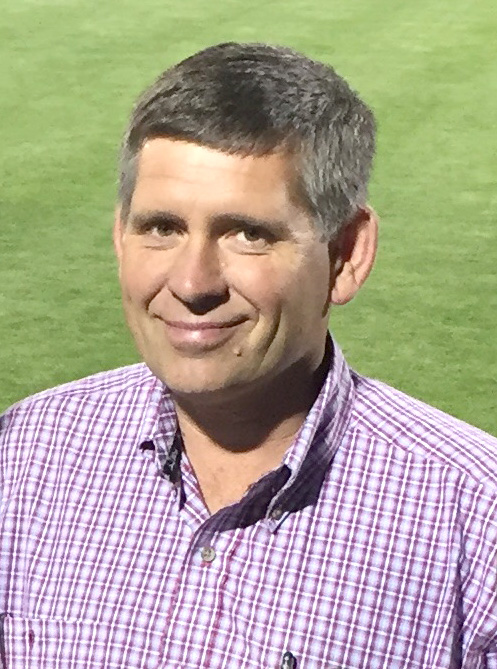

Rock County livestock producer Grant Binford said he welcomes the support, but he said it’s important to keep perspective.

“It’s frustrating on a lot of levels,” he said Monday. “The system is broken and has been for a long time. … We don’t have very many cattle negotiated anymore; it’s all contracted on a formula.”

But he agreed that the pricing doesn’t make sense.

“When grocery stores started clearing out products shortly after restaurants closed, we saw boxed beef at $2.08 for choice beef, and today it’s at $4.50,” Binford said.

The price producers receive for live cattle, however, has cratered to historic lows.

For easy figuring, Binford used the May 8 comprehensive beef box price of $3.91 per pound for a 900-pound beef carcass and compared it to the current $1.60 per pound for the same 900 pounds.

That means the packing company is getting $3,500 and the cattle producer is getting $1,440.

“There’s a lot of country between those two numbers,” Binford said.

He recognized the variables (such as costs of production for processors) that are factored into pricing, but the supply and demand formula isn’t adding up.

“I’m going to be fair about this and point out that we’re part of a cyclical business,” Binford said.

“The packer has leverage when supplies are up, and other times when we don’t have as many numbers, the leverage comes back to us because the shortage is in our favor.”

The coronavirus closures of meat processing facilities, he said, has created market disruptions the industry hasn’t seen before.

“The problem now is that demand is good, but we can’t get the product to consumers,” Binford said. “We’ve harvested about 35 percent fewer animals in the past week with the packing plant disruptions.”

He added that government shelter-in-place measures have gone too far and lasted too long.

“We need to change course and get stuff opened up again,” he said. “And the rest of us need to get over this and get out there again.”

But it’s not just the farmers affected by the current market setup, according to the attorneys general requesting a federal investigation into meat packers manipulating prices.

They said consumers are negatively impacted as well, particularly amid economic challenges posed by the new coronavirus pandemic.

“Given the concentrated market structure of the beef industry, it may be particularly susceptible to market manipulation, particularly during times of food insecurity such as the COVID-19 crisis,” the attorneys general wrote.

“[W]e would suggest that regulatory strategies should be explored to promote competition, address market manipulation and protect consumers.”

As of Monday, President Trump said he supported the investigation and would consider forming a task force to look into the allegations.