The Hardwick City Council unanimously agreed to move forward in establishing Rock County’s first Rural Service District.

Attorney Don Klosterbuer is working with the council to adopt an ordinance creating dual tax rates — one for urban and one for rural properties — within the city limits of Hardwick.

The move would result in fairer taxes for property owners whose ag land falls within city limits.

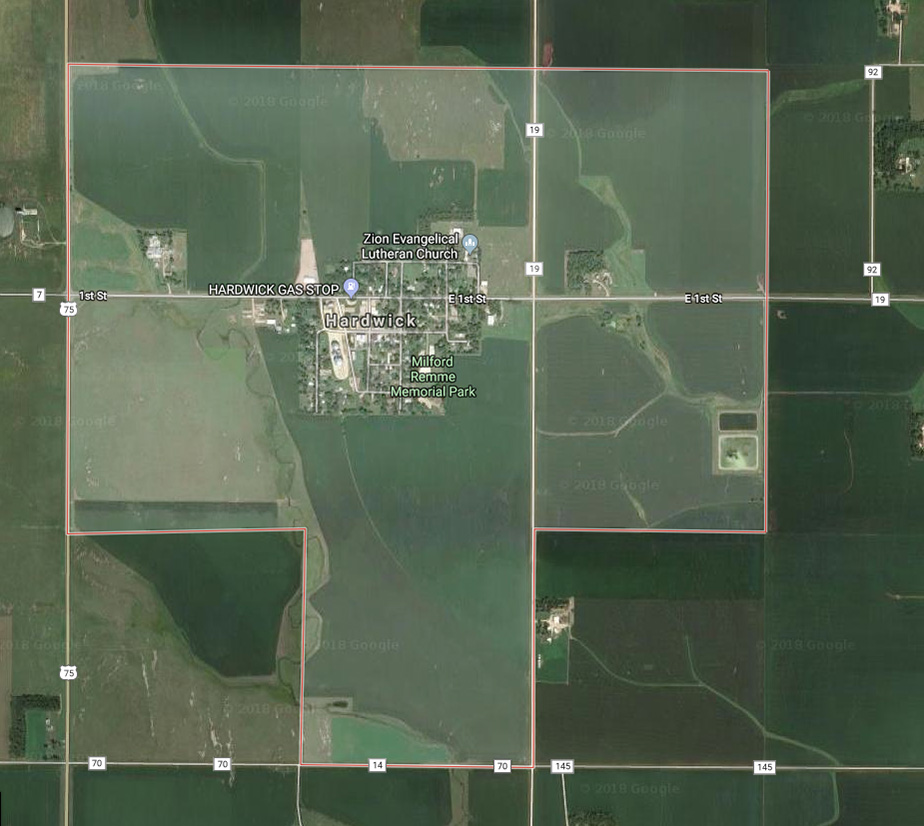

The city limits for the town of 222 residents includes 1,100 acres, 997 of which are classified as agricultural.

“There is a lot of property within the city limits that is agricultural property … that gets taxed and the tax revenues come into the city,” Klosterbuer said during a May 1 Hardwick City Council meeting.

In 2019 the city collected $26,087 of its $55,138 levy from six ag property owners paying 47 percent of Hardwick’s tax revenue.

“To say the least, it is substantially higher than rates that similar ground would be paying in a township,” Klosterbuer said.

Barb Loosbrock, one of the six property owners, attended the May 1 city council meeting.

Klosterbuer used parcels owned by Loosbrock and her husband, Robert, to illustrate the tax differences between similar 80-acre tracts of farmland, one within the city limits taxed at $5,270 and one outside the city limits taxed at $223.

“When two pieces of land are right together, the difference is like day and night,” Loosbrock said.

Klosterbuer agreed to facilitate a meeting between the six landowners and the council representatives to examine each land parcel to determine a “benefit ratio,” or a percentage of services the property receives from the city.

Benefits mentioned at the council meeting included sewer, water, garbage and snow removal.

Currently the nine rural parcels determined for the rural service district are taxed as if they’re receiving 100 percent of city services.

Klosterbuer outlined different scenarios illustrating the effects a rural service district would mean to the city and affected rural property owners.

At 50 percent benefit designation, collectively taxes on the nine properties would be $15,391. At 25 percent, taxes would be $10,043.

The levy on residences and businesses, which have 100 percent access to city services or urban service district, stayed at $29,051, under Klosterbuer’s scenarios.

To make up the shortfall from fewer rural tax dollars, council members would need to raise taxes in the urban district or cut services.

“Taxes in this town are pretty low,” said councilman Sam Hansen. “Our taxes, if we go through with this, would be raised to make up for lost revenue.”

However, Hansen added, an urban tax increase to only make up for the loss of the farm properties would only maintain current city services and would not allow any needed improvements unless taxes were increased over and above the lost revenue.

“What else are we going to do,” he asked. “We have to sit down with you people and decide to do what is fair.”

Ron Fick of Luverne spoke on behalf of Gertrude Bruynes, another one of the six affected ag property owners.

Fick first approached the council three years ago about the differences in taxes on farmland.

“I totally understand where you’re coming from — it is really difficult — but when the Bruynes family has to write that huge check with absolutely getting nothing back, it is difficult on our side (too),” he said. “I would like to see us work with you guys to do something.”

Bruynes, a former Hardwick resident now living in Luverne, is slated to pay $18,834 in taxes to the city of Hardwick in 2019.

Fick said Bruynes is prepared to go forward with detachment proceedings, if an agreement cannot be reached.

“We have been talking about this for three years almost, and it hasn’t happened and every year that bill keeps coming for the taxes,” Fick said. “Something needs to be done now or we need to pursue it.”

The affected ag landowners could petition the courts to detach from a city and the city would receive no taxes if the detachment were granted.

The new ordinance must be in place by Aug. 1 in order for it to affect taxes in 2020.

Hardwick City Clerk Tammy Johnson summarized the council agreement at the May 1 meeting.

“We have a deadline to be done next year and that’s what we’re going to do,” she said.