The Luverne Economic Development Authority will provide relief for local businesses suffering economic hardship as a result of temporary closures for coronavirus prevention.

Qualifying businesses — nearly 80 non-residential accounts — will see a credit on their May utility statements equal to half of three months worth of their average bills.

Members of the LEDA, which met via conference call Monday morning, approved the “Stop Gap Utility Deferred Loan Program” in an attempt to lessen the economic blow of lost business during state-mandated closures.

Director Holly Sammons used the example of an account with a $200 average monthly bill. Three months is $600, so the one-time credit would be $300.

“And the best part is, we calculate it for you; you don’t have to do anything,” she said. “We wanted to make this as reasonable and easy as possible.”

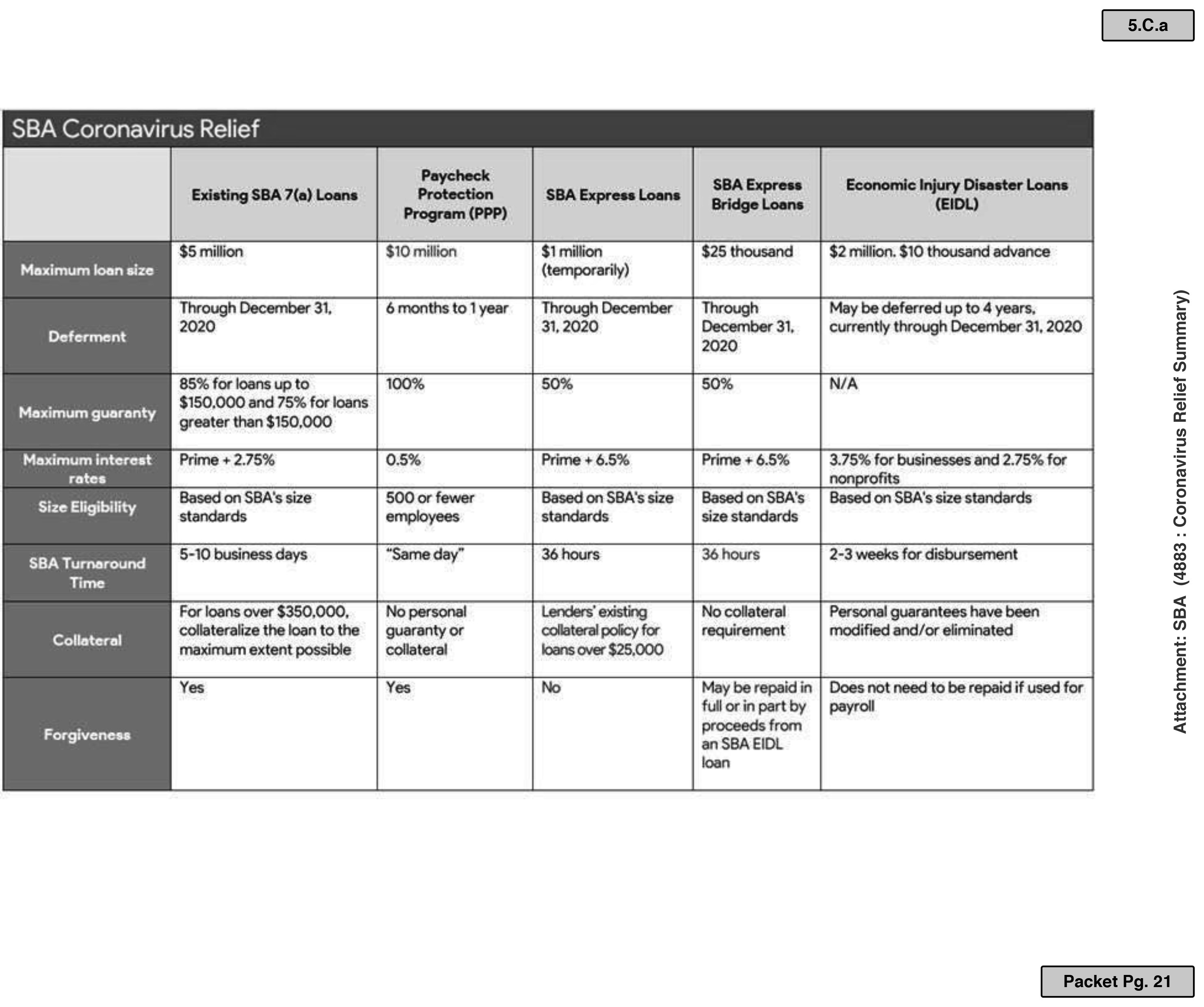

State and federal relief programs have complicated application processes, and relief may not arrive for several months. That’s why Luverne leaders wanted to do something in the interim.

Qualifying businesses are any listed under Gov. Tim Walz’s executive orders 20-04, 20-08, and 20-20 mandated to close in order to slow the spread of the virus. The list is long and includes restaurants, bars, gyms, theaters, bowling alleys, coffee shops and more.

“The LEDA recognizes the adverse impact these orders may have on small businesses within our community while still waiting for state and federal programs to become available,” Sammons said.

She and Luverne Finance Director Barb Berghorst have identified qualifying accounts, determined their average utility bills from the past 12 months and calculated their loans based on 50 percent of three months of average bills.

The total amount the city will defer comes to roughly $89,000.

“We want to make sure every single business in Luverne is open for business when this economic downtown is past,” Mayor Pat Baustian said during the meeting. “A little shot in the arm with financial utility help is a great thing that we can do.”

The EDA also determined that if an executive order is made at the state or federal level indicating the closure of certain business operations extending past May 4, or the review committee determines the local business climate remains unimproved, the deferred loans may be forgiven.

A review committee will consider applications from other businesses inadvertently missed or not originally selected to be eligible to determine if they should qualify for the deferred loan.